In today’s world, where the stakes are extremely high in the world of proprietary trading, success is not just about great marketing or skilled traders; it is about having the right infrastructure from day one. For founders that are trying to build a Forex, Futures, Crypto, or Sports-based prop firm, selecting the right backend technology is not just an advantage, but it is a game-changer. That’s exactly where Trade Tech Solutions (TTS) steps in, helping firms with everything that is needed to launch, scale, and lead the industry.

Trade Tech Solutions is more than just a software provider. The platform provides features such as full-scale, white-label infrastructure designed specifically for scalability, fraud control, trader management, and for revenue optimization. The platform is currently providing tech for 45 live prop firms, and supports more than 83,000 traders across 180 countries. Let’s explore how TTS stands out from other similar platforms.

What Trade Tech Solutions Does- and Why It Matters

The TTS platform provides white-label infrastructure to launch and operate prop trading firms. It does not matter if the company wants to enter Forex, Futures, Crypto, or even Sports prop space; TTS has got them covered. The platform will equip them with:

- A modular backend engine to create custom trading challenges, manage trader lifecycle, track drawdowns, and CRM

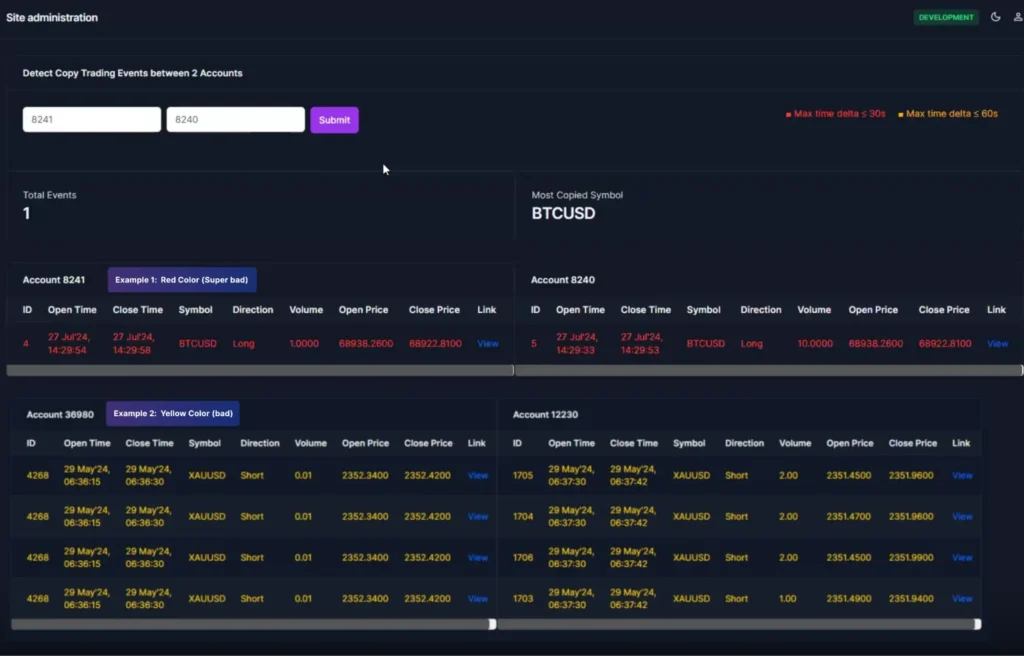

- Real-time fraud detection tools are also provided for copy trading, account sharing, and news-event abuse

- Seamless integration with trading platforms such as MetaTrader5, TradeLocker, Match-Trade, Volumetrica FX, cTrader, NinjaTrader, Quantower, VolumetricaTrading, VolBook, VolSys, Atas, and Tradovate.

- Integrated payment gateway with 50+ PSPs (Payment Service Providers) including Stripe, Coinbase Commerce, Google Pay, and more

This platform is just not a simple dashboard skin or some affiliate plugin pack, but it is a solid, battle-tested base that can be customized with the user’s own branding.

Built by Founders, Not Outsourced

The company was founded by the CEO of Goat Funded Trader, someone who has run a successful prop business and knows in and out of the operations. With this, it is evident that every feature, every system, and every integration in the TTS suite exists because it has solved a real problem for a real team in the past.

In a field where other providers guess what a founder might need, TTS builds what founders know they will need.

Solving the Real Reasons Prop Firms Fail

Trade Tech Solutions is not trying to do anything that is flashy, but it is trying to build a platform that is your go-to place for all things prop firm infrastructure.

As far as we have observed, most of the prop firms fail because of scalability issues, weak fraud protection, and bloated tech stacks.

Trade Tech Solutions solves all of these problems. The platform has a cloud-native architecture, which means that it runs on scalable infrastructure. The platform can easily handle 100-100,000 users without slowing down or having a breakdown. There is no need to rebuild anything when the users grow.

The platform has a fully integrated admin portal, through which things like trader data, risk events, payments, and challenge progression can be monitored on a single dashboard. Founders and operations teams can monitor and act on critical insights without having to jump between disconnected tools.

As the platform also provides automated risk monitoring features, it can easily track drawdowns, account sharing, copy trading, and flag issues that could be a problem in real-time. The best part here is that it does not lock founders and firms into rules and regulations; it actually gives founders the final call, with full context.

Risk Control as a Competitive Advantage

In today’s environment, the prop firm game is more about mitigating abuse than it is about onboarding new users. TTS stands out with its real-time risk engine that flags and tracks:

- Copy trading behavior (mirror trades, repeat strategies)

- Inverse trading between funded and challenge accounts

- Shared IP logins and suspicious access patterns

- Trading during restricted news windows

- Automated and manual drawdown tracking

This means no more guessing if someone is gaming your system, and no more hard stops on vague breaches. The platform logs everything with time stamps and leaves the final judgment to the founder. It is not just about protection, but it is about preserving profitability at scale.

Full-Stack Admin and CRM: All-in-One Command Centre

TTS puts the full trader lifecycle into one comprehensive dashboard, which includes:

- Challenge management: The platform can configure instant or phased models, set custom pass/fail logic, and auto-issue certificates for passed traders.

- CRM: View each trader’s entire journey from start to funded payouts. One can also have a look at breach status, KYC status, phase progression, and more.

- Revenue intelligence: The firm can access data on revenue insights by challenge type, trader cohort, user behavior patterns, and active funnel bottlenecks.

- Drawdown tracking: The platform tracks drawdowns with timestamped logs and daily/max metrics, automated alerts, and complete historical records.

- Admin role permissions: The platform makes sure that every team member has access to only what they need, with internal action logging for traceability.

The dashboard is created in such a way that it provides operational clarity to everybody.

Seamless Payments and Payout Forecasting

For any prop firm, the flow of cash is everything as it is important for paying traders, maintaining trust, scaling operations, and surviving volatility. Trade Tech Solutions streamlines the entire revenue process to make sure more money moves efficiently and transparently. Let’s find out how:

50+ Integrated Payment Providers: As mentioned above, the platform accepts more than 50+ integrated payment providers such as Stripe, Razorpay, CoinPayments, PayPal, and Apple Pay. The platform connects various global and local PSPs. This makes it easier to make payments, whether it is through fiat currency or cryptocurrency.

Multi-Currency, Multi-Asset Support: The platform also supports multi-currency and multi-asset support. The user could be operating in INR, USD, EUR, or Bitcoin, but the system can handle multi-currency inputs and outputs, which allows smoother transactions for global users.

Payout Forecasting Dashboard (7-Day Outlook): This feature allows founders and the finance team visibility into upcoming withdrawals. This, in turn, helps the user plan for liquidity and avoid any last-minute shocks. It is like having a CFO dashboard that says, “Here’s what is going out next week, are we ready?”

Built for Speed-to-Market and Long-Term Scale

In this industry, timing is everything. With Trade Tech Solutions, you can launch your prop firm in just weeks rather than months, with all the essential systems already built and ready to go.

The architecture is:

- Modular: This means that the firm can easily add or remove features as the firm grows.

- Cloud-native: As mentioned above, this feature allows the firm to scale from 100 to 100,000 users without having to rewrite the code.

- Flexible: The platform is compatible with top trading platforms across various asset classes.

Supported platforms include:

- CFD: MetaTrader5, TradeLocker, Match-Trade, cTrader, Volumetrica FX

- Futures: NinjaTrader, Tradovate, Quantower, VolBook, ATAS, VolSys, and VolumetricaTrading

Engagement & Retention That Drives Revenue

Prop firms are not just trading operations, but they are also media and gamification engines. TTS knows that and it builds for it.

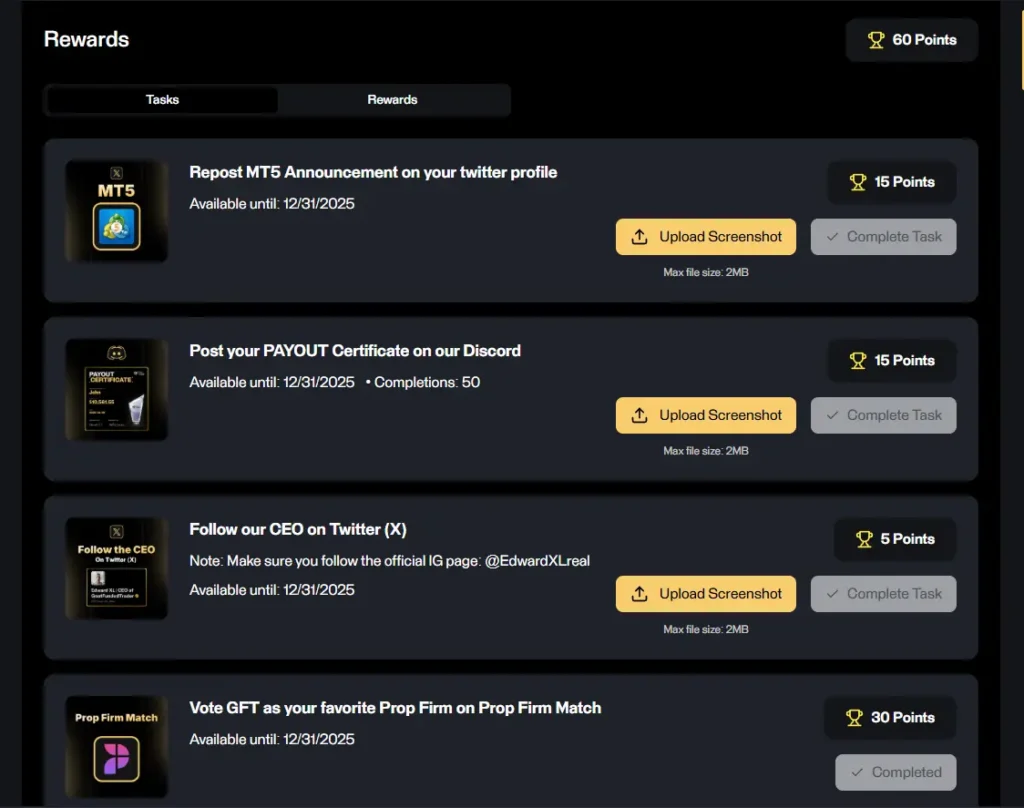

The other standout feature includes the platform’s built-in reward system, which is designed to drive engagement across key behaviors. The platform provides features where they can earn points, complete tasks, and unlock perks that create loyalty loops. This is what drives the traffic and reduces churn.

A quick look at the statistics of the built-in reward system:

- A recent case study showed that there was a 110% traffic spike after the launch of the reward system.

- The revenue lifted by 26% in the first 30 days of the launch.

- 16,000+ users engaged in the reward system within the first 30 days of the launch.

All these numbers suggest that this feature is something that will multiply the revenue.

No Fees Until You Launch

Most of the SaaS platforms start charging the company or the firm from Day 1, but TTS follows a founder-first pricing model. The firm does not have to pay monthly platform fees until it is live. This reduces upfront risk and gives founders breathing room to focus on the quality of the launch and not on the costs.

Always Evolving with Real Feedback

One of the biggest challenges with most prop firm platforms is that they are built once, and then they just become stagnant. Founders are lost, and they usually find themselves stuck with rigid systems that do not keep up with their operational needs or user growth.

Trade Tech Solutions has a different approach to such situations. The platform is designed in such a way that it is adaptable and dynamic. The development is shaped by direct input from the founders who have already used the platform. None of the decisions for change are based on internal assumptions. Whether it is tweaking the dashboard layout, adding new metrics to the risk module, or supporting a new payment gateway, updates are rolled out based on actual day-to-day needs from real operators.

This indicates that the platform just does not work when the firm launches, but it keeps getting better as it grows. With this platform, the firms are a part of a user base and their voice directly shapes the final product.

All of this is important as it helps the tech and the platform keep up with the business and not the other way around.

Final Verdict: The Only Tech Stack That Thinks Like a Founder

The main aim of Trade Tech Solutions is to provide an infrastructure for launching and operating proprietary trading firms that are scalable, secure, and fully backend-integrated.

The platform has developed features that are rare as they have been built around real-world challenges like fraud prevention, payout planning, and trader management. The platform has focused more on what actually matters and how day-to-day operational problems can be solved.

Trade Tech Solutions is built for founders who are serious about creating a scalable, long-term prop firm, offering the tech and support needed to thrive in a competitive space.